Tax Tips You Need To Know Before Filing Your 2022 Taxes

Tax Tips You Need To Know Before Filing Your 2022 Taxes

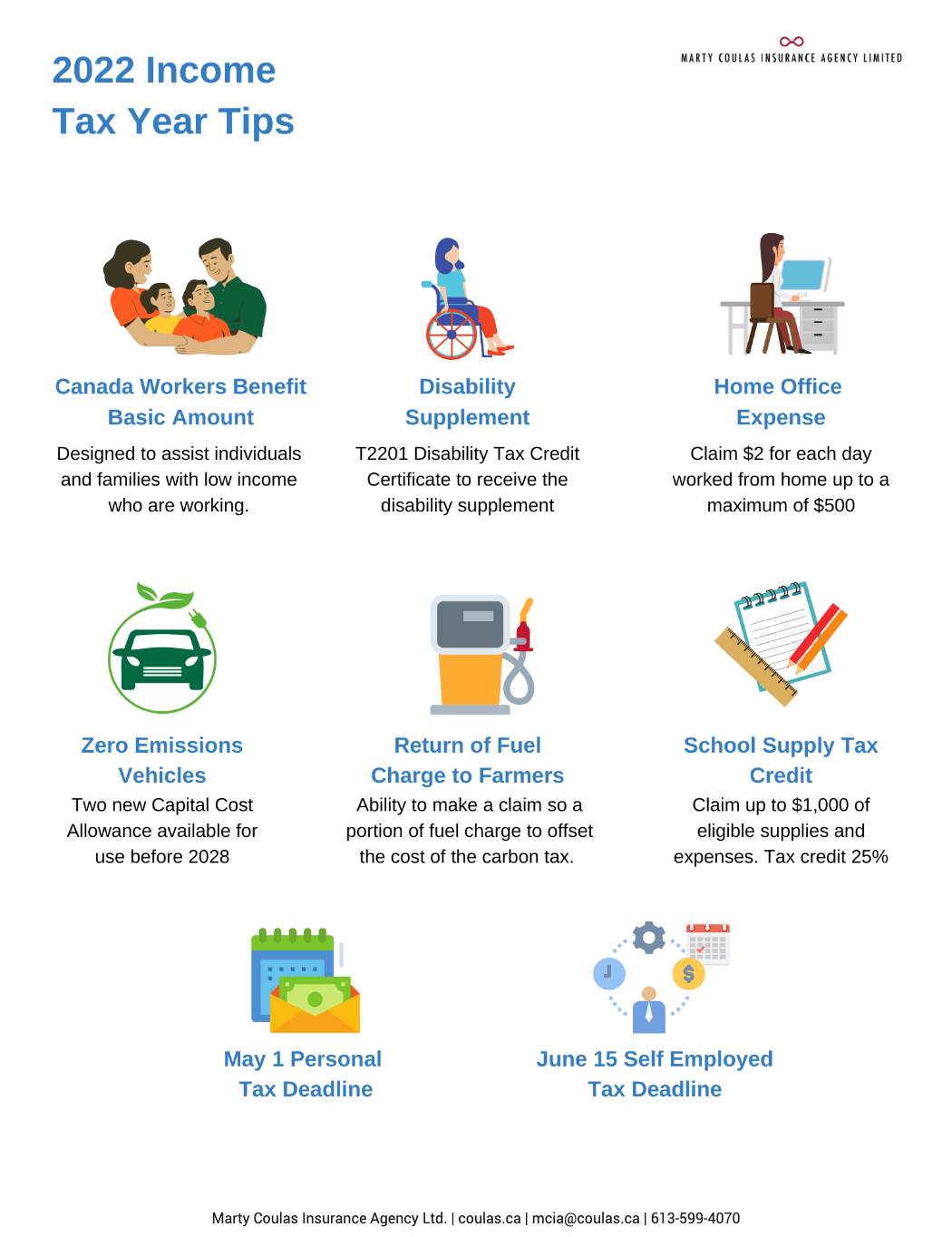

This year’s tax deadline is May 1, 2023, as April 30 falls on a Sunday this year. It’s important to make sure you’re claiming all the credits and deductions you’re eligible for. In this article, we’ll provide you with tips to help you maximize your tax refund and ensure you’re taking advantage of all the available tax benefits.

Canada Workers Benefit

The Canada Workers Benefit (CWB) is a refundable tax credit designed to help low-income working families and individuals. The credit is made up of two parts:

-

The basic amount

-

A disability supplement (if you qualify).

To determine whether you qualify for the tax credit, you’ll need to consider your net income and where you live. The CRA website provides full details about the net income qualification amounts.

The maximum amounts you can qualify for are as follows:

-

The maximum basic amount is $1,428 for single individuals and $2,461 for families.

-

The maximum amount for the disability supplement is $737 for single individuals and $737 for families.

Claiming Home Office Expenses Due To COVID-19

You can still claim home office expenses if you’re not self-employed but worked from home due to the pandemic. You can:

-

Claim the temporary flat amount if you worked more than 50% of the time from home for at least four consecutive weeks in 2022. You can claim $2 for each day worked from home, up to a maximum of $500. No paperwork or forms are required!

-

Use the detailed method and claim the actual amounts. In this case, you’ll need supporting documentation, plus a completed and signed T2200S form from your employer. You can claim various applicable expenses, including home Internet access fees.

The Tax Deduction for Zero-Emissions Vehicles

A capital cost allowance (CCA) is a tax deduction that helps cover the cost of an asset’s depreciation over time. The CRA created two new capital cost allowances, which apply to zero-emission vehicles bought after March 18, 2019.

They are as follows:

-

Class 54. This class is for motor and passenger vehicles, excluding taxis or vehicles used for lease or rent. It has a CCA rate of 30%. For 2022, capital costs will be deductible up to $55,000, plus sales tax. This amount will be reassessed every year.

-

Class 55 is for leased and rented vehicles or taxis. The CCA rate is 40%.

Return Of Fuel Charge Proceeds To Farmers Tax Credit

You may be eligible for this tax credit if you are either self-employed or part of a farming partnership in Alberta, Manitoba, Ontario and Saskatchewan.

This tax credit aims to help farmers offset the high cost of the carbon tax.

Eligible Educator School Supply Tax Credit

You can claim up to $1,000 of eligible supplies and expenses if you qualify for the educator school supply tax credit.

The tax credit rate for the 2022 tax year is 25%, with a maximum credit of $250.

Need help?

Do you qualify for a credit or deduction? Call us – we’re here to save you money on your taxes!